As the House and Senate contemplate reconciling differences in Senate Bill 1 and House Bill 4001, the Small Business Association of Michigan (SBAM) is requesting that the final version of the bill include certain provisions to avoid pitfalls in the current construction of the legislation.

To be clear, SBAM is not requesting changes in current law. But since changes appear to be imminent, our small business owner-driven policy position calls for equitable treatment of small business workers and retirees. While we have received a clear message that the House and Senate are not willing to entertain equal treatment between pensions, 401Ks, IRAs and working seniors, it is our hope that the disparities between different seniors can be narrowed to avoid creating a presumably unintentional penalty against seniors who remain in the workforce.

Our interest in the legislation is to 1) achieve more equitable treatment for retirees of small businesses and 2) to reduce or eliminate the tax penalty inherent in these bills against working seniors.

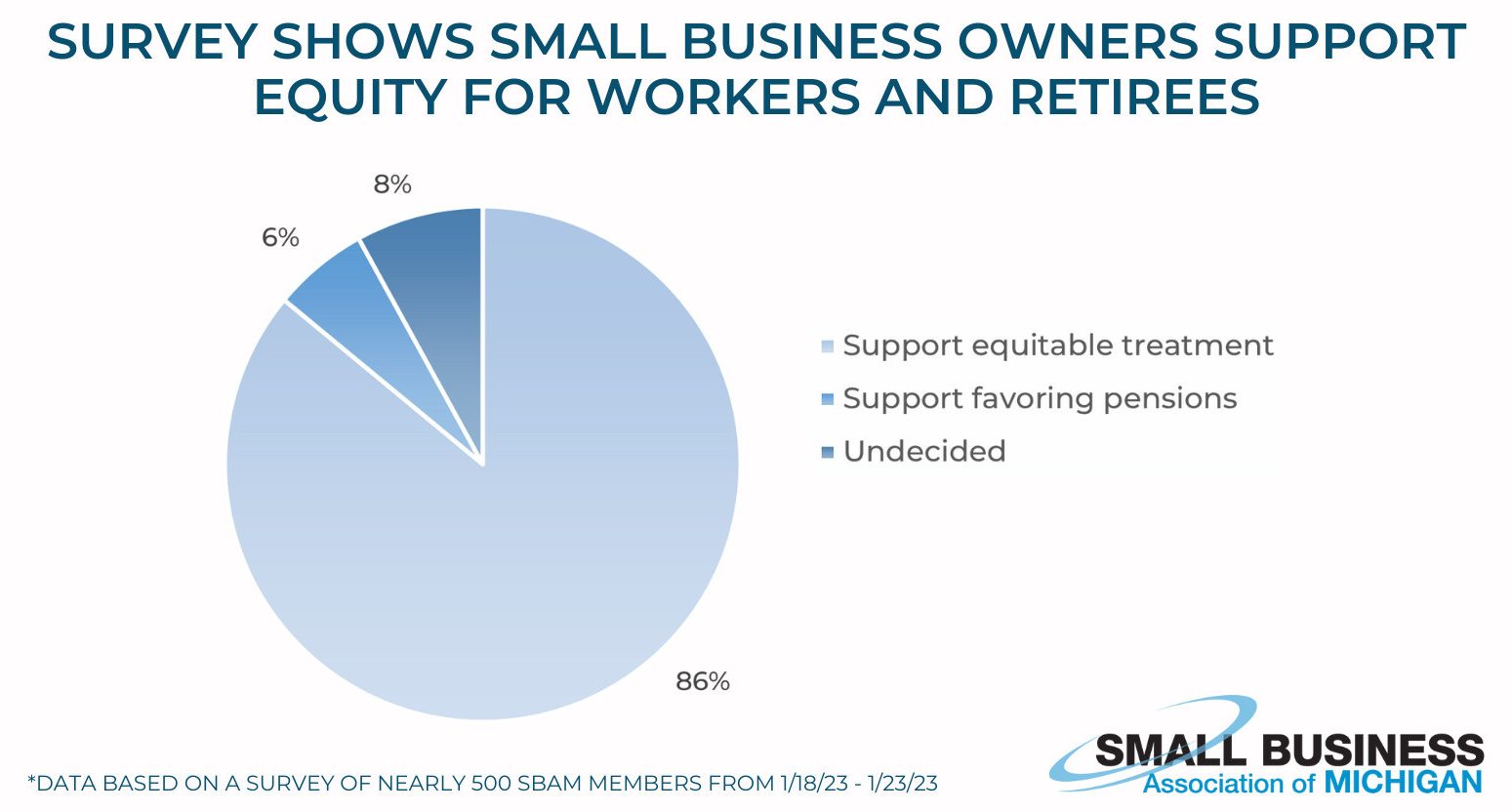

86% of small business owners support equity for private sector workers and retirees.

A survey of nearly 500 small business owners conducted between 1/18/23 and 1/27/23 found strong support for equitable treatment of 401Ks and IRAs which are most often utilized by small business owners and their employees. The survey found that 86% of small business owners supported equitable treatment, with just 6% favoring pensions and 8% undecided. It is highly unusual for any issue to have this level of consensus among our members.

Do not penalize workers.

Michigan’s labor force participation rate is 11th worst in America and has stalled out around 60%. We remain below pre-pandemic levels. HB 4001 and SB 1 create huge inequities between retired seniors and those who remain in the workforce. Some seniors remain in the workforce because they want to, while others have no choice. Either way, these seniors are no less important and no less worthy of equitable treatment as compared to those who can afford to retire. We ask that working seniors be treated at least as fairly as those who retire with IRAs and 401ks.

Establish exemptions for the private sector that include the middle class.

While there is not a formal definition of the middle class, Pew Research Center defines it as those earning between two-thirds and twice the median household income. In Michigan, this population could be fully included if the exemptions for private sector retirees and senior workers were set at $65,000 for single filers and $130,000 for joint filers. As it stands, the exemptions for working seniors would not even cover the ALICE Senior Survival Budget amount.

The Proposal:

- Increase exemptions to $65,000 and $130,000 for single and joint filers respectively to encompass the middle class. Index the amounts to inflation (consumer price index).

- Expand eligibility of the exemption to seniors who remain in the workforce.

Allow working seniors to start claiming this exemption upon attainment of the age of 59.5 which is the age that typical private sector retirement accounts are eligible for withdrawal without penalty.