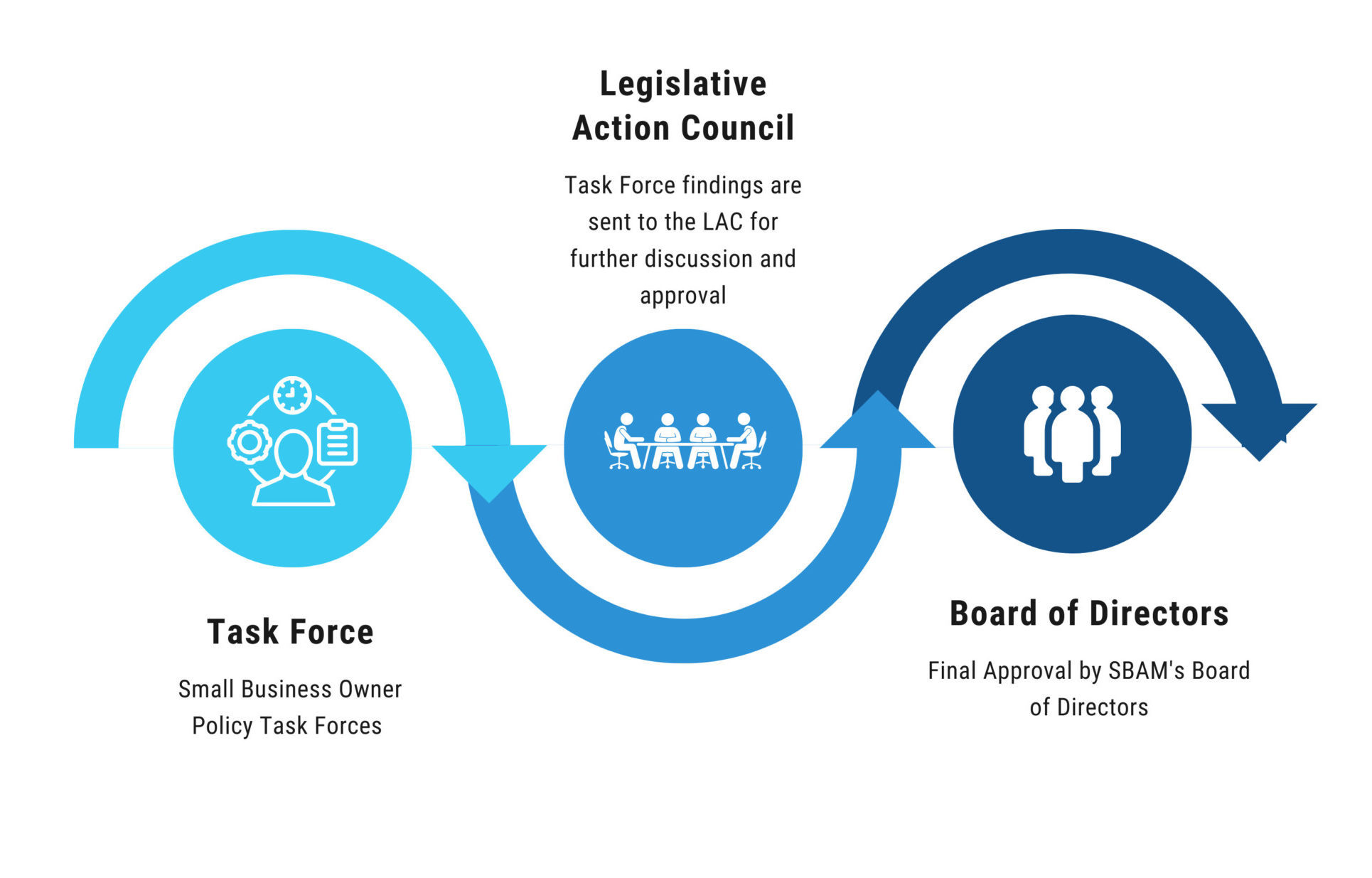

Legislative Agenda & Task Forces

2023 Legislative Agenda

SBAM’s proactive policy agenda gives policymakers direction and insight from Michigan small business owners. These tenets represent our approach to creating an environment of success for small business.

Small Business Needs People – Business needs people with the right skills to meet their demand

People Need Place – People need communities that are growing and present a high quality of life to them

Place Needs Small Business – Our communities need small businesses to remain thriving