$1.8B-Plus in Fee Program Extensions, Fee Increases in Budget Implementation Bills

October 3, 2023

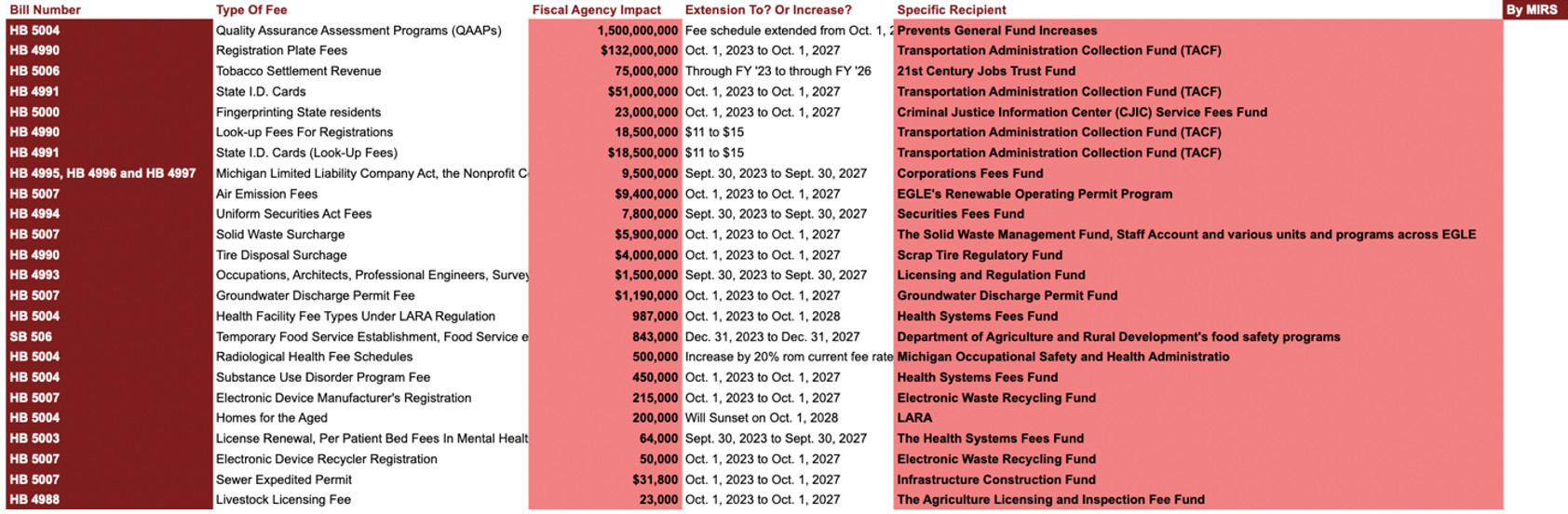

The Senate was scheduled to vote on more than $1.8 billion worth in both continued and some elevated fees, administered across various departments, last Wednesday.

Twenty-one total budget implementation bills are currently sitting in the chamber, including various extensions to fee programs that are set to expire this fall. MIRS reviewed each of the procedural bills Tuesday, which are designed to sustain restricted funding in the upcoming years and to provide official direction for Fiscal Year (FY) 2024 budget appropriations.

In terms of programs with the most restricted revenue to be secured by the state, a sunset extension in HB 5004 for the quality assurance assessment programs (QAAPs) fee schedule – a tax on medical providers used to boost Medicaid reimbursements while minimizing General Fund costs – could ensure about $1.5 billion in restricted funding in the state.

The approved Michigan Department of Health and Human Services budget for Fiscal Year (FY) ’24 assumes HB 5004 will be in place, with the fee schedule for QAAP taxes on nursing homes, ambulance services, and hospital long-term care units sunsetting on Oct. 1, 2027 instead of on Oct. 1 of this year.

The same tax program involving hospitals, beyond their long-term care units, would technically conclude on Oct. 1, 2027 – instead of October 1.

Following HB 5004 in monetary value, HB 4990 would maintain around $132 million in revenue for the Transportation Administration Collection Fund (TACF), by similarly extending the sunset to Oct. 1, 2027 for the Department of State to collect money from specialty and fundraising license plate purchases, as well as for certain regulatory fees on commercial and organizational vehicle uses.

Moreover, HB 5006 requires $75 million to be deposited annually into the 21st Century Jobs Trust Fund for the next three years, as opposed to concluding in the recent FY ’23, from tobacco settlement revenue. The 21st Century Jobs Trust Fund is within the state’s Department of Treasury and can be spent on state-financed economic development activities, like community revitalization projects and business attraction initiatives, as they are determined through each year’s budget-making process.

Specifically, the budget implementation legislation on Wednesday’s agenda consisted of HB 4988, HB 4990, HB 4991, HB 4993, HB 4994, HB 4995, HB 4996, HB 4997, HB 5000, HB 5003, HB 5004, HB 5006, HB 5007, SB 506, SB 507, SB 508, SB 509, SB 510 and SB 511.

From the Democratic majority’s perspective, lengthening the lifespan of multiple fees and lifting the price-tag of several is a status quo procedure, going directly into a restricted pot of money with a specific purpose. However, as some GOP legislators did in the House, Republican senators could challenge such continuations and cost boosts.

For example, on Sept. 20, Rep. Andrew Beeler (R-Port Huron) referred to the fees in a press release as an attempt by Democrats to “squeeze every last nickel and dime out of Michiganders – just so they can waste the money on unsustainable programs and unnecessary projects.”

“When Democrats passed their bloated budget this summer, I voted ‘no’ on behalf of Michigan taxpayers. Now, I’m again voting ‘no’ on these uncalled-for fee hikes on working Michiganders and small businesses,” he said.

The $1.86 billion MIRS gathered from the budget implementation bills would be equal to 77% of all one-time expenditures in the general omnibus budget for FY ’24, which totaled more than $2.4 billion.

As for all spending in both the education and general omnibus budget for FY ’24, worth more than $81.6 billion, the restricted funding secured in the aforementioned bills would be worth less than 2.5% of that.

However, the legislation does not exclusively deal with department-run fees or fee increases, like the jump from $11 to $15 for look-up fees involving registration plates and state I.D. cards that are projected to deliver $37 million, combined, to the TACF in HB 4990 or HB 4991.

Additionally, two of the bills, SB 509 and SB 510, would increase the number of days the Michigan Department of Agriculture and Rural Development has to issue or deny license applications among the state’s grain dealers from 30 days to 60 days.

Article courtesy MIRS News for SBAM’s Lansing Watchdog newsletter

Click here for more News & Resources.