Business Owners and CARES Stimulus

By Leon C. LaBrecque, originally featured in the September/October edition of FOCUS Magazine

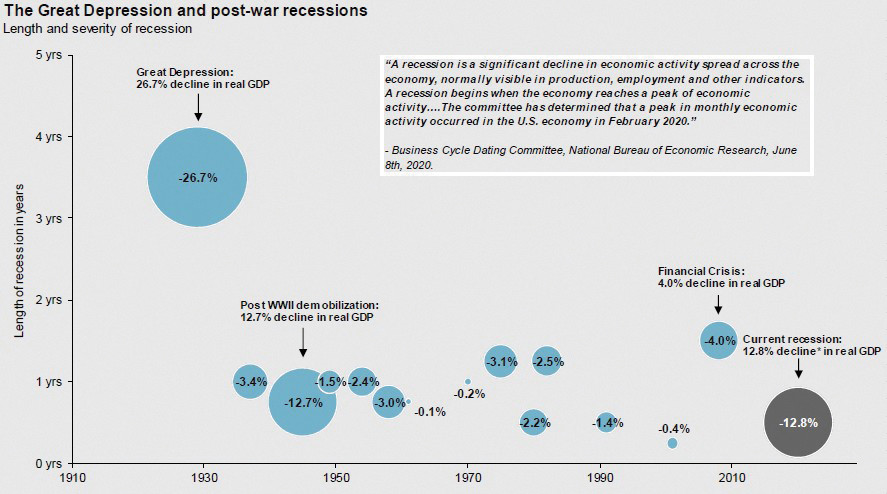

LET’S JUST BE HONEST—2020 HAS BEEN A COLOSSAL MESS. For the first time in 100 years, we’ve encountered a NON-manmade economic crisis. The economic punch delivered by the coronavirus pandemic is staggering, dropping the U.S. gross domestic product (GDP) by the second largest decline in history, second only to the Great Depression. By comparison, the current recession (thus far) has three times the decline in GDP of the Great Recession of 2007-2009.

At the same time, we’ve seen a more rapid response and stimulus effort than ever before. The Federal Reserve rode to the rescue with Washington on its heels bringing trillions in fiscal and monetary stimulus. Federal Reserve Chairman Jerome Powell noted, ‘We will do whatever it takes,” and they have, thus far, lived up to that promise. Here is a summary of items for business owners to consider before year end, based on the current business-oriented stimulus programs.

Paycheck Protection Program (PPP): The big one on everyone’s mind is the PPP. It’s a good idea, allowing businesses with less than 500 employees to borrow a forgivable loan covering about two and a half months of certain payroll and other expenses. After a few missteps, the program is still in effect with greatly broadened forgiveness provisions. You can find an AICPA forgiveness calculator at https://www.pppforgivenesstool.com/ and borrowers should note there is a short form for forgiveness, as well as a comprehensive application. Make sure to get the forgiveness application in before December 31, 2020, or sooner, if you can. There appears to be an appetite in D.C. to add more restrictions to the program.

Payroll Taxes: The employer portion of FICA is deferred for the remainder of 2020. This allows an employer to effectively save the employer portion of payroll taxes for the employees. Many commentators warn that deferring payroll taxes does not amount to forgiveness. Given the draconian penalties associated with failing to pay the employer portion of employee payroll taxes, business owners may want to carefully discuss possible ramifications of this option with their CPA.

Employee Retention Credit (ERC): The ERC give employers a payroll tax credit for eligible employees equal to 50 percent of the qualified wages, limited to $10,000 per employee for all calendar quarters, paid by the employer after March 12, 2020, and before January 1, 2021, if:

Operations were fully or partially suspended in any calendar quarter by a federal, state or local government order due to the COVID-19 virus; or

The employer experienced a substantial decline in gross receipts during any calendar quarter beginning in the first calendar quarter of 2020.

Which employees’ wages are considered qualified wages for purposes of this credit depends upon the average number of employees during 2019. Additionally, wages included in the calculation of the credit for emergency paid sick leave and family leave are not qualified wages for purposes of this credit, and an employee is not considered an employee for purposes of this credit if the employer is receiving a work opportunity credit with respect to the employee. An eligible employer who receives a covered SBA 7(a) loan (including a PPP loan) is not eligible for this credit.

Net Operating Loss (NOL): The ‘Hidden Stimulus’ in the CARES Act is the reinstatement of the NOL carryback. Under the Tax Cuts and Jobs Act (TCJA), NOLs could only be carried forward and then only at 80 percent. The CARES Act allows NOLs to be carried back five years.

This presents the interesting possibility of carrying back a loss to a higher tax-bracket year. For example, the maximum C-corp rate in 2020 is 21 percent, whereas in 2015 it was 35 percent. Used this way, the NOL would produce an instant tax refund. Combine NOLs with other provisions like full-expensing, and 2020 abounds with massive tax planning opportunities. The same applies to Excess Loss Limitations for pass-through owners. Under the TCJA, these were limited, but now a pass-through owner can fully utilize losses against any other income.

Qualified Improvement Property (QIP): QIP was a weird ‘glitch’ in the TCJA that was subsequently fixed in the CARES Act. This provision allows certain improvements to property, like air conditioning or alarm systems, to be written off over 15 years instead of being added to the basis of the property. In addition, QIP is available for bonus deprecation, so you can use it for full expensing and an immediate write-off. This could generate a NOL, which could generate an income tax refund from prior years.

COVID 401(k)/IRA Withdrawals: There are special no-penalty withdrawals available for up to $100,000 (per spouse) from qualified plans and IRAs. The tax on the distribution is spread over three taxable years (2020, 2021 and 2022). If you pay it back by December 31, 2022, there is no tax (any taxes paid are refunded).

The Bottom Line: To say this is an interesting year would be an understatement. As a business owner, it is important that you and your CPA carefully look at the special provisions effective for this year. Time is ticking on this, so my advice is to start sooner rather than later.

By the way, there’s an election coming up as well, which might change taxes again. If you have questions, drop me an email at llabrecque@sequoia-financial.com; I’ll do my best to answer them.

Leon C. LaBrecque, JD, CPA, CFP®, CFA, has invested more than thirty years in pursuit of one goal—enriching the lives of everyday people by helping them understand their financial lives. LaBrecque has authored multiple books and been featured in media outlets like InvestmentNews, CNBC, USA Today and Forbes. He is currently the Chief Growth Officer of Sequoia Financial Group: https://www.sequoia-financial.com